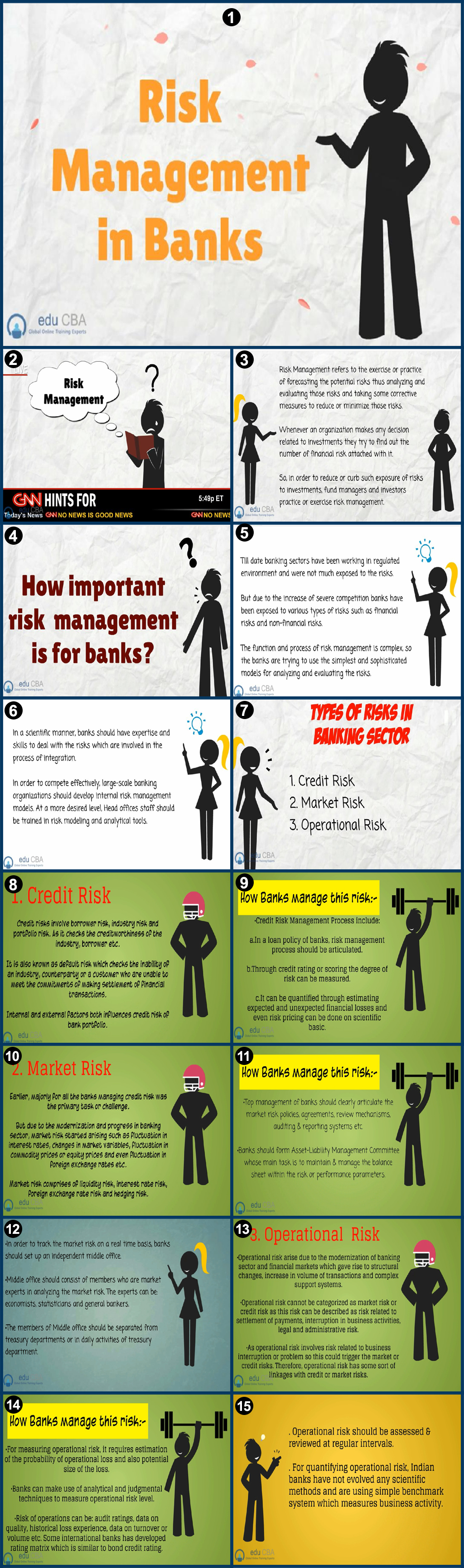

Risk Management In Banks. A successful ERM process would ensure that risk taken by the bank is compensated by a commensurate level of reward and the bank is completely The risk management process becomes more robust because of common data structure and a common technology architecture supporting the. We all come across with the word risk in our life but have you ever wondered where this word originates from???

The risk function at banks is evolving from being a.

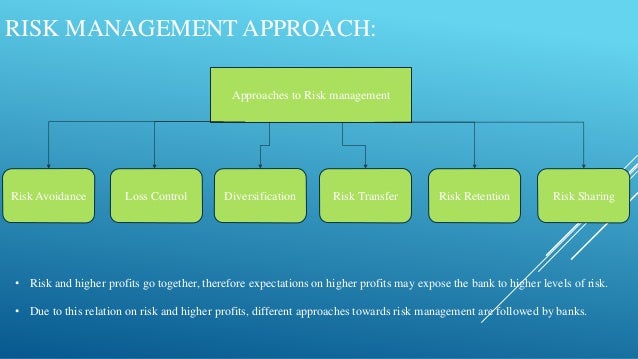

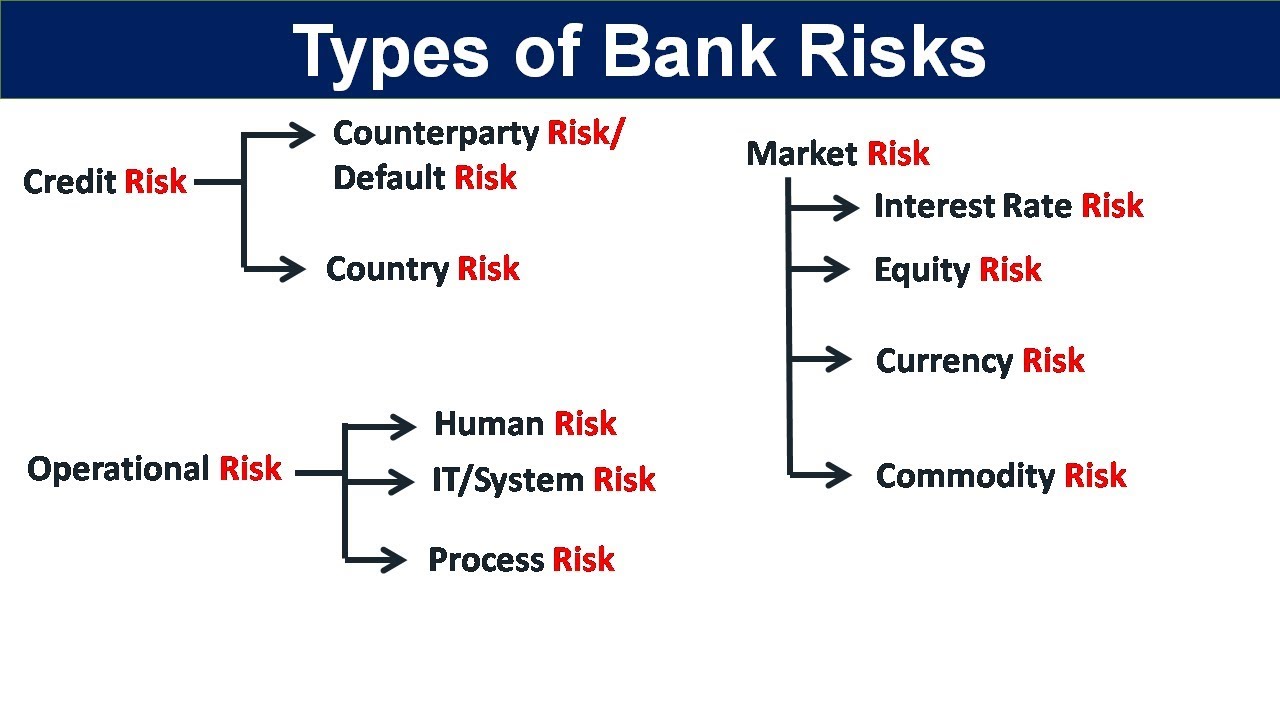

Some of the Risks which bank faces are Risk management is important for banks to ensure their profitability and soundness.

Risks taken in central banking activities need to be analysed in a holistic manner, considering the interaction of different portfolios and operations. Since risk management in relation to e-banking is generally complicated and evolving (especially in respect of operational risk), it is vital for an AI to As part of the risk governance for e-banking, AIs' senior management should establish clear policies and accountability to ensure that a rigorous. If a bank is perceived to be in a financially weak position, depositors will withdraw their funds.