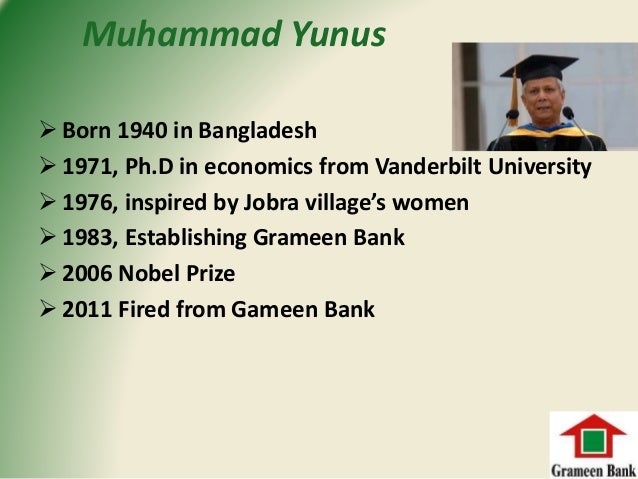

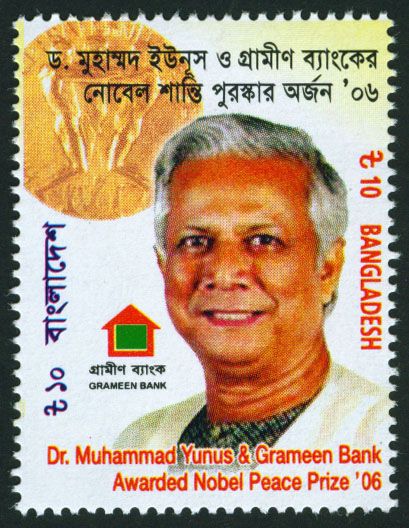

Muhammad Yunus Grameen Bank. As the founder of the Grameen Bank in Bangladesh, Yunus demonstrated that lending money to poor people to start businesses could be profitable and could transform their lives by raising. Muhammad Yunus is known throughout the world as a pioneer of the microcredit concept that uses small loans made at affordable interest rates to transform the lives of impoverished people, mostly women.

Yunus built Grameen upon a self-sustainable model of micro loan lending that targets the Bangladeshi poor (particularly women) so.

Muhammad Yunus, Grameen Bank founder, discusses his banking philosophy designed to end poverty. (Source: Bloomberg).

Muhammad Yunus is known throughout the world as a pioneer of the microcredit concept that uses small loans made at affordable interest rates to transform the lives of impoverished people, mostly women. His objective was to help poor people escape from poverty by providing loans on terms suitable to them and by teaching them a few. The Grameen Bank of Bangladesh created the model for large-scale "micro lending" in the developing world, in the process What's more, its founder, Muhammad Yunus, became internationally-known for his management of the organization; Yunus became among the best-known of what is said to be a.